Careshield Life Singapore

All others will have to. To check if you are enrolled in a CareShield Life Supplement you can log on to the Central Provident Fund CPF website using your SingPass account details.

Compulsory Careshield Life To Start On Oct 1 For Residents Born In 1980 Or Later Health News Top Stories The Life Activities Of Daily Living Health Check

CareShield Life is a government-sponsored disability insurance programme that started in October 2020.

Careshield life singapore

. The scheme currently provides cash payouts of 300 or 400 per month for up to 5 or 6 years. Caring for You for Life. The payouts are more flexible as they are not limited to. You will be automatically covered when you turn 30 or if you are between 30 to 40 years old.This is regardless of pre-existing medical conditions and disability. The premium amount will. CareShield Life and Long-Term Care Act. CareShield Life in Singapore.

Best CareShield Life Supplement Plans Singapore 2021. Only Singaporean citizens and PRs who are already enrolled under a CareShield Life plan can apply for CareShield Life Supplements. So better learn to make full use. CareShield Life is mandatory for all Singapore Citizens or Permanent Residents born in 1980 or later.

From 6 November 2021 the scheme is ready for eligible Singapore Citizens and Permanent Residents born in 1979 or earlier to join. To help Singaporeans survive while living with a disability Singapores government implemented CareShield Life. In addition receive extra monthly payouts from our Caregiver Benefit 4 and. Monthly careshield life payouts start at 600.

Starting careshield life payouts for singaporeans with severe disability will be higher than under the existing eldershield scheme. Careshield Life Payout Increase. Benefits of Health Insurance. SINGAPORE - From Nov 6 eligible Singapore citizens and permanent residents PRs born in 1979 or earlier can join CareShield Life the long-term care insurance scheme to provide basic financial.

Your supplementary coverage starts early with additional monthly payouts 1 and a lump sum Initial Benefit 2 upon the inability to perform just one of the six Activities of Daily Living 3 ADLs. GREAT CareShield supplements your CareShield Lifes starting monthly payouts of S600 in 2020 that increase over time. However do keep in mind that only Singapore Citizens and Permanent Residents born between 1980 to 1990 aged 30 to 40 in 2020 with a CareShield Life policy are currently eligible to apply. The Singapore government has come out of various compulsory schemes such as MediShield Life and CareShield Life that help aid every Singapore Citizens and Singapore PR to have basic health insurance.

To get you up to speed weve handpicked a few of the best CareShield Life supplements in the market to see which of these plans offer more bang for your buck. More information about each plan can be found on the respective providers websites. With the new careshield life you now receive s600 per month from the start and the payouts will increase over time for life. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration.

Existing ElderShield 400 policyholders who were born in 1970 to 1979 will be automatically enrolled and do not need to take action to join. Cant run away la. To add on to the coverage provided by CareShield Life insurers have launched CareShield Life. All Singapore Citizens and Permanent Residents born on or after 1980 will be automatically covered under CareShield Life from 1 October 2020 or upon 30 years of age whichever is later.

Long-term disability support scheme CareShield Life will soon be open to Singaporeans and permanent residents born in 1979 or earlier the. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. We will help you. Why do we need CareShield Life.

Existing ElderShield 400 policyholders who were born in 1970 to 1979 will be automatically enrolled and do not need to take action to join. Frequently Asked Questions about CareShield Life. Click here to find out more about. We can never time when an accident or illness befalls us.

CareShield Life benefits are designed to provide you with lifetime protection and assurance for your basic long-term care needs should you become severely disabled. Living with a disability can be very expensive. Auto Enroll into careshield life from 30-40 yo Born Between 1980 - 1990. For Singaporeans born 1979 or earlier CareShield Life will be launched for them by end 2021.

What is CareShield Life. Called CareShield Life the government-run scheme will be compulsory automatically getting everyone who is between the ages of 30 and 40 in. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. Lifetime coverage cash.

ElderShield was introduced in 2002 as a basic long-term care insurance scheme targeted at severe disability especially during old age. CareShield Life helps you financially should you become severely disabled and require long-term care. Singapore News - From Nov 6 eligible Singapore citizens and permanent residents PRs born in 1979 or earlier can join CareShield Life the long-term care insurance scheme to provide basic. Enrolment in CareShield Life is encouraged as it will provide better protection than ElderShield through higher and lifetime payouts said the Health Ministry.

All others will have to. The CareShield Life and Long-term Care Bill was passed in Parliament in 2019 to provide long-term care for Singapores ageing population. For those who dont know about CareSheild CareShield Life is a disability insurance plan that pays for both personal and medical expenses. If you become severely disabled the scheme will pay you a monthly income no matter where you live in the world.

MediShield Life is a basic health insurance plan that protects all Singapore Citizens and Permanent Residents against large hospital bills for life regardless of age or health condition. Anastassia Evlanova Senior Research Analyst updated on June 10 2021. However we can practice.

![]()

Careshield Life Vs Eldershield In 2021 Activities Of Daily Living Life Financial Planner

Pin On Careshield Life Insurance

Singapores Best Critical Illness Insurance 2020 Critical Illness Insurance Critical Illness Activities Of Daily Living

Opinion Why I Think Careshield Life Is Good For You With 600 Monthly Payout Life Life Is Good Best

My Thoughts About Nikko Am Sgd Investment Grade Corporate Bond Etf Corporate Bonds Investing Investment Portfolio

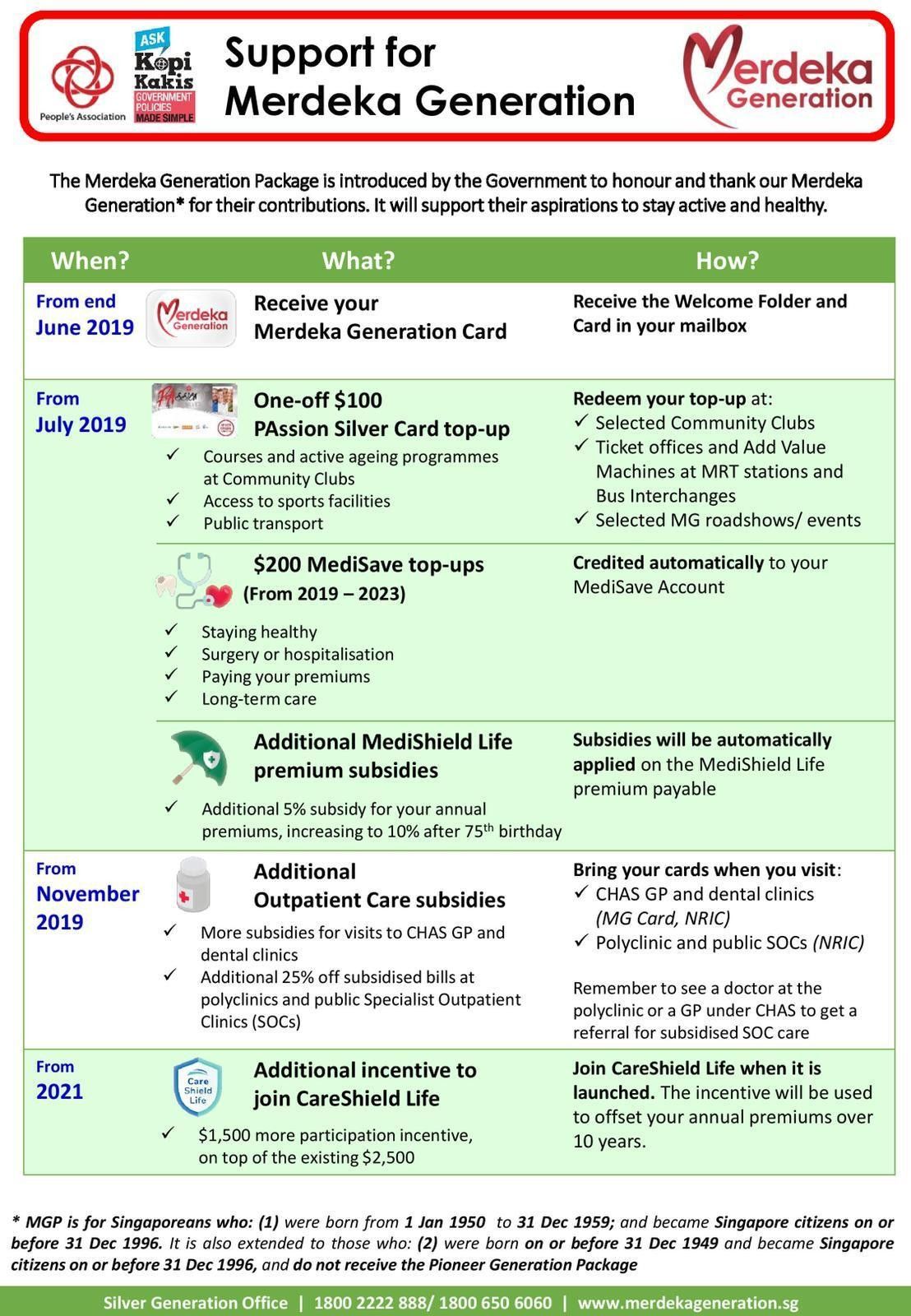

Pin By Meng Yeong On Information Support People Supportive Generation

终身健保终身护保乐龄健保有什么不同 早报 Pa Life Gaming Logos Life

The Real Singapore Inc Why We Dont Have A Global Company Singapore Real Global

Post a Comment for "Careshield Life Singapore"